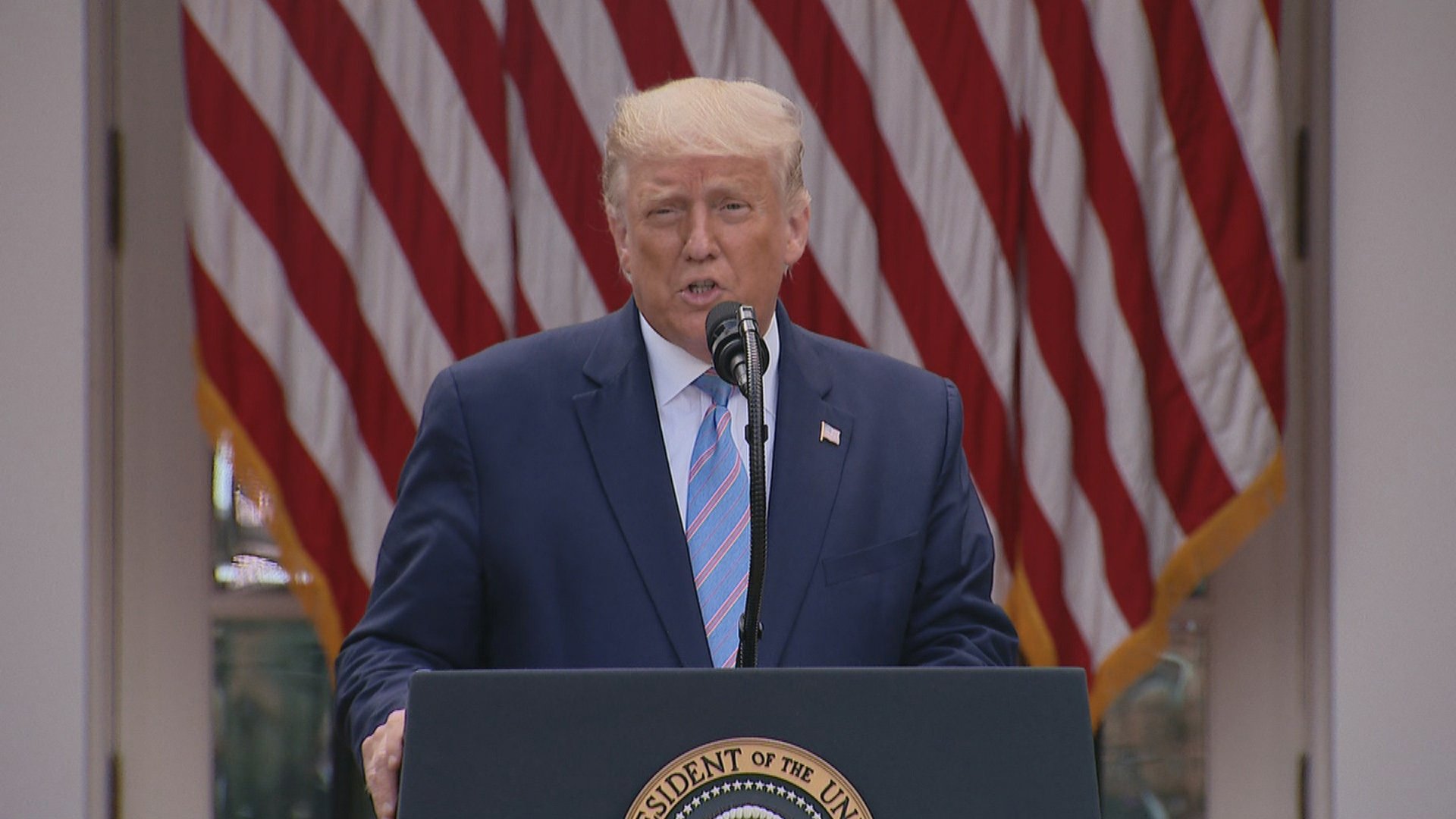

Simple income tax filings are complicated enough, but the web of companies President Donald Trump owns or has a major stake in make his returns a veritable labyrinth.

While Trump continues to battle in court to keep his financial records from becoming public, the New York Times got troves of Trump tax returns from unnamed sources. The records appear to show that Trump paid no federal income taxes in all but five of the 15 years leading up to his run for the White House, and only $750 in federal income taxes the year he was elected and his first year in office.

Thanks to our sponsors:

Stephanie Hoffer, the tax chair of Indiana University’s law school, said it’s hard to draw definitive conclusions without actually looking at the documents.

But she said it appears as if Trump took tax practices from the playbook of his father.

“Some of the things that come out that seem particularly egregious really aren’t surprises at all. So for instance, Trump’s massive borrowing followed by forgiveness of debts, and the payments — the large consulting payments that he’s making to his children” are the same patterns employed by Fred Trump, she said.

Other practices appear to take advantage of modern shifts in tax law. Trump appears to have taken advantage of a tax break put in place when his political nemesis, former President Barack Obama, strove to help businesses struggling during the recession.

Trump used it to “carry losses back to prior years, to offset his income from ‘The Apprentice’ and the reason why it caught my eye is that there’s a similar provision in the CARES Act (enacted during the coronavirus pandemic) around net operating losses that allows them to be carried back into years prior much further than they could have been before, and I’m sure that this is a provision that Trump and his companies will benefit from moving forward,” Hoffer said.

According to the New York Times, Trump also classified his Seven Springs mansion in New York as a business expense rather than a personal property, which allowed him to write off the property taxes even as the 2017 federal tax overhaul he heralded strictly limited property tax deductions for homeowners, a change which has impacted homeowners in Chicago and the suburbs.

“There’s things like that that will strike people … kind of as deeply wrong,” said University of Chicago law professor David Weisbach. “He’s claiming a deduction where then he passed a law that prohibits us from claiming.”

Despite the intricacies of tax law, Weisbach said some of the takeaways from the Times’ reporting are easy to digest.

“He’s paid $750 in taxes two years running and yet, you know, is flying on private airplanes and living a lavish lifestyle. I think that’s going to strike a lot of people as generally wrong,” Weisbach said.

Both he and Hoffer said that consultant fees Trump businesses paid to a corporation helmed by daughter Ivanka Trump, despite the fact that she already worked for the family corporation, appear to be an attempt to get money to Trump’s children without paying an inheritance or estate tax at rates above the income tax, something that Weisbach said the Times’ article did not make explicitly clear.

The reporting shows that Trump’s businesses have losses the experts interviewed by WTTW News describe as “staggering.”

Weisbach said it's possible that Trump may just enjoy being a celebrity at the golf courses he owns, even if they’re losing money.

Or the losses may show that Trump is a bad investor and businessman.

He said it may also show that some of the losses or deductions claimed by Trump may not be legitimate.

Or it could be a combination, Weisbach said.

Georgetown law professor Brian Galle, a former prosecutor who specialized in tax evasion cases, said although he needs more details, the facts reported by the New York Times “ring familiar to people who have seen a lot of these family business tax evasion cases. That is, there seem to be a series of payments for things that are fundamentally personal or largely personal, but that seem to have been characterized as coming from the business.”

For example, the Seven Springs property, parties, the use of private jets and claiming a deduction of $70,000 for haircuts.

Trump’s trademark bouffant may be key to his public image, but case law is clear that hairstyling cannot be claimed as a business expense, Galle said.

“You can’t deduct your hairstylist expenses, even if you’re a model,” Galle said.

In addition to the losses, the Times reports that Trump has borrowed hundreds of millions of dollars that are to come due to unspecified lenders, in addition to potentially facing a $100 million tax liability should he be on the losing end of an ongoing IRS audit.

U.S. House Speaker Nancy Pelosi has said that it’s a security concern; the outstanding debts also raise concerns on a personal level, if not a “tax geek” one for Galle.

He said the network of tax issues facing Trump presents potential dilemmas given his position.

“As far as I know, we’ve never seen anyone with this expensive of a tax dispute with the IRS. For sure I’ve never seen anyone with $400 million in personal debt be president. You’ve got to think that those kinds of obligations create significant pressure, even for the most public-minded person,” Galle said. “The fact that you owe $400 million to possibly some very tough customers, that’s got to be at least in the back of your mind.”

Galle points to reports of Trump’s interest in who would serve as the top legal counsel at the IRS.

“That was at the time that the Congress was starting to make noise about trying to obtain the president’s tax returns, so possibly that was just about keeping the returns secret. But he may have also had in mind that he had a $73 million dispute with the IRS,” Galle said.

While she hasn’t seen the documents to draw her own conclusions, Hoffer said her gut tells her that the general outrage at Trump’s low tax liabilities is evidence of the sort of frustrations tax experts such as herself have long felt.

What’s described at the very least “pushes the boundaries” of tax planning, Hoffer said – potentially to places that are “improper,” but she said much of what Trump did to get his federal income tax bill so low are permissible practices likely employed by other real estate investors and wealthy individuals with business webs.

The Times reporting, she said, makes these methods more visible to the public.

Regardless of the results for Trump personally, she said voters should “look at what Congress is permitting” in tax law, and have a conversation about that.

Trump’s challenger for the presidency is sure to try to push that conversation, if not from a policy perspective then from a political one, at Tuesday’s first presidential debate.

On Monday, the Biden campaign unveiled a website with a tax calculator that allows people to compare their 2017 tax liability with the $750 Trump paid.

The calculation is that middle-class Americans will be motivated to vote against Trump when they learn how much more they paid than the self-avowed wealthy president did.

Follow Amanda Vinicky on Twitter: @AmandaVinicky

Thanks to our sponsors:

Thanks to our sponsors:

"all" - Google News

September 29, 2020 at 10:02AM

https://ift.tt/33dmBkk

New Revelations About Trump's Taxes. What It All Means - WTTW News

"all" - Google News

https://ift.tt/2vcMBhz

Bagikan Berita Ini

0 Response to "New Revelations About Trump's Taxes. What It All Means - WTTW News"

Post a Comment